The 10-Minute Rule for Estate Planning Attorney

The 10-Minute Rule for Estate Planning Attorney

Blog Article

What Does Estate Planning Attorney Mean?

Table of ContentsAn Unbiased View of Estate Planning AttorneyNot known Incorrect Statements About Estate Planning Attorney Estate Planning Attorney for BeginnersThe Best Guide To Estate Planning Attorney

Estate preparation is an action plan you can make use of to determine what occurs to your possessions and commitments while you live and after you die. A will, on the various other hand, is a legal record that details how properties are distributed, who deals with kids and animals, and any various other desires after you pass away.

Claims that are rejected by the executor can be taken to court where a probate judge will have the last say as to whether or not the insurance claim is valid.

5 Easy Facts About Estate Planning Attorney Described

After the supply of the estate has been taken, the value of properties determined, and tax obligations and financial debt repaid, the executor will after that look for consent from the court to disperse whatever is left of the estate to the recipients. Any kind of estate tax obligations that are pending will come due within 9 months of the date of death.

Each individual locations their properties in the trust and names someone various other than their spouse as the recipient., to sustain grandchildrens' education and learning.

What Does Estate Planning Attorney Do?

Estate planners can collaborate with the contributor in order to minimize taxed revenue as an outcome of those payments or formulate methods that maximize the effect of those contributions. This is another approach that can be utilized to limit fatality taxes. It entails a specific securing the current value, and hence tax liability, of their residential or commercial property, while associating the value of future growth of that funding to an additional person. This visit the site technique involves cold the worth of a property at its value on the day of transfer. As necessary, the amount of possible funding gain at death is likewise iced up, allowing the estate planner to estimate their potential tax responsibility upon death and much better plan for the settlement of revenue tax obligations.

If adequate insurance policy profits are available and the plans are appropriately structured, any earnings tax obligation on the considered dispositions of possessions complying with the death of a person can be paid without turning to the sale of assets. Proceeds from life insurance that are received by the recipients upon the death of the guaranteed are normally revenue tax-free.

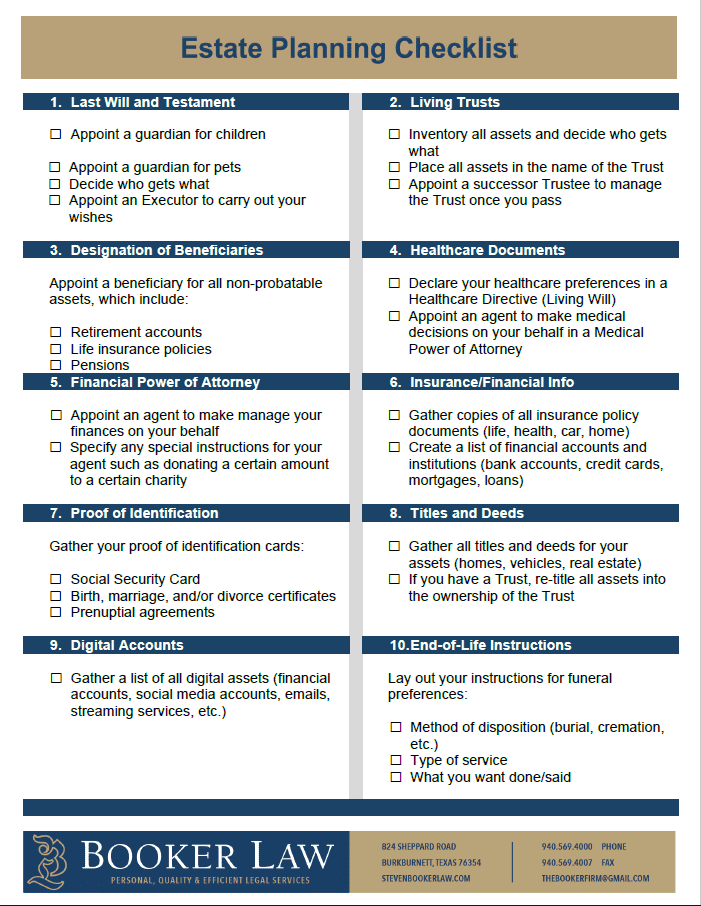

Various other fees connected with estate planning include the preparation of a will, which can be as reduced as a few hundred dollars if you use among the ideal online will certainly makers. There are specific papers you'll need as part of the estate planning process - Estate Planning Attorney. Several of the most common ones include wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a myth that estate planning is only for high-net-worth individuals. That's not true. review Estate preparation is a device that everyone can utilize. Estate intending makes it simpler for people to identify their dreams prior to and after they pass away. Contrary to what the majority of people believe, it expands beyond what to do with assets and obligations.

Estate Planning Attorney Can Be Fun For Anyone

You should begin preparing for your estate as soon as you have any kind of measurable possession base. It's a recurring process: as life progresses, your estate strategy must move to match your circumstances, in line with your brand-new goals. And maintain at it. Refraining your estate preparation can cause unnecessary economic burdens to loved ones.

Estate preparation is commonly assumed of as a device for the wealthy. Estate planning is additionally an excellent means for you to lay out strategies for the treatment of your small kids and pet dogs and to detail your dreams Your Domain Name for your funeral and favorite charities.

Applications should be. Eligible candidates who pass the test will be officially licensed in August. If you're eligible to rest for the exam from a previous application, you may submit the brief application. According to the guidelines, no certification will last for a duration much longer than 5 years. Discover out when your recertification application schedules.

Report this page